Neal Bailes – 2023 Top 20 Individual Producer in the State of Tennessee

United Wholesale Mortgage (UWM) has named Neal Bailes 2023 Top 1% “Best of the Best” Individual producer in the United States. Neal is one of the Top 20 Individual Purchase Producers in the State of Tennessee and UWM, United Wholesale Mortgage, is the Number 1 Lender in America. Neal considers being in the top of UWM for individual production an honor and would like to thank Knoxville and the surrounding communities in helping make this possible. He was also a Top 20 Individual Purchase Producer for UWM in 2022.

____________________________________________________________________________

Letter of Gratitude for Real Estate Finance Group’s 20 Year Anniversary

As we celebrate our twentieth year anniversary on June 1, 2021, I want to take this opportunity to thank all of you who are part of our community at Real Estate Finance Group for your dedicated support. It is your courage, your commitment, and your belief in the Vision of Real Estate Finance Group that has made this possible.

Real Estate Finance Group was borne out of my deep commitment to serving the mortgage industry at every level possible. After experiencing the limitations of the traditional bank model, I was passionate about creating a Wholesale Mortgage channel for all clients, without compromising my expertise as a traditionally trained Mortgage Banker. The vision of Real Estate Finance Group is based on Honesty, Integrity, and Experience which our society is in deep need of today.

In the past twenty years, much has transformed, grown and evolved at Real Estate Finance Group. We have established ourselves as a model of Mortgage Lending that is cost effective, commitment to excellence centered. I am an integrative Mortgage Broker that has established a new norm for mortgage lending and incorporates all of the above. With your support I pride myself on working with the most ethical and accomplished Realtors, Title Companies, and Lenders in Knoxville and nationwide.

Thank you all for your support, your confidence, and your commitment to what is real.

Warmest Regards,

Neal Bailes

____________________________________________________________________________

Interest Rates

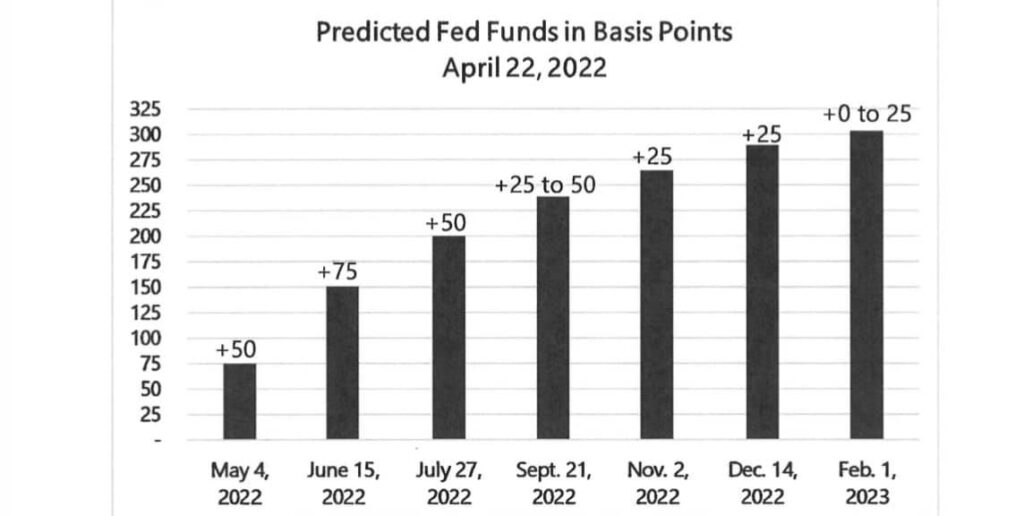

Interest Rates have continued to climb since January 1, 2022. This chart shows the probability weighted forecast for Fed Funds by Fed meeting date as tracked by the Chicago Mercantile Exchange’s Fed Watch Tool.

The Chicago Mercantile Exchange’s (CME) FedWatch Tool examines the likelihood of FOMC (Federal Open Market Committee) rate changes for future meetings. The tool uses 30-Day Fed Fund futures pricing statistics, this data has been used for decades to ascertain the market’s temperament concerning the probability of adjustments to the monetary policy of the U.S.

The CME FedWatch Tool envisions both contemporary as well as past likelihoods of different FOMC rate change results for any specific meeting date. In addition, the Fedwatch tool also exhibits the “Dot Plot” of the Fed, which displays FOMC members’ estimates for the target rate of the Fed and the rate’s changes over time.

Your credit score has always been important but it’s more important now than ever before. If you have a 739 credit score, a borrower with a 740 will get a better deal on interest rates/fees. Teach your kids that their credit score is how a bank views their character and how responsible that they are. If you have a credit card or credit line. Don’t ever charge more than 70% of that credit line.

I personally don’t believe in credit card debt, it’s a trap in my opinion. I do understand that many Americans need to have it in certain times. Credit cards are great if you use them responsibly and pay them off each month. You can earn points or rewards as well as raise your credit score with credit cards. Higher rates are absolutely coming. Congratulations to everyone who has below a 3% interest rate on your mortgage. In 25 years I’d never witnessed rates like we had in 2020 and 2021 at below 3%. I don’t think we will ever see that again.

Since Interest Rates are expected to continue to rise throughout 2022. A recession is likely in 2022 and beyond. A good idea for some people is to open up a personal line of credit and or a Home Equity Line of Credit on their home. Only use this if you need to use it but I have seen people wait until they need these instruments but be denied for whatever reason. People should be proactive and set up strategies just in case things go bad when things are good.

If you wait until you desperately need it, you might not be able to be approved for these lines. I personally witnessed this back in 2008 and 2009 when a 2 income earning family went to one income due to layoffs. They wanted and needed to tap into their home equity but could not qualify because of having only 1 income. This is just an example of waiting for a recession to come and not be ready.

Have a great day friends!

Sincerely,

Neal Bailes